Contents

Your credit report may list any address associated with an account with which you are associated. This means that if you are a joint account holder or an authorized user on an account and the bills are sent to someone else’s address, that address could appear on your report as well..

How do I remove an old address from Credit Karma?

Log into Credit Karma. On a browser, hover over Profile and Settings. Select personal information from the drop-down menu. Enter or select from the drop-down menu your new information, and click Save.

What is Experian dispute mailing address?

By mail: You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013.

How can I lift my credit score?

Steps to Improve Your Credit Scores

- Build Your Credit File.

- Don’t Miss Payments.

- Catch Up On Past-Due Accounts.

- Pay Down Revolving Account Balances.

- Limit How Often You Apply for New Accounts.

How do I change my address with TransUnion?

TransUnion: If you would like to update your address directly with the agency, send a letter stating your new address to TransUnion at P.O. Box 2000, Chester, PA 19016, along with two qualifying documents.

How long does it take TransUnion to update address?

TransUnion will typically update their consumer credit reports when they receive new information from a credit reporting agency. Most agencies will send new data every month or at least every 45 days. So, from the TransUnion standpoint, credit reports are typically updating as soon as information arrives.

Do I need to freeze my credit report at all 3 bureaus?

You’ll need to file a credit freeze request with all three major credit bureaus for it to be effective. During the process, you’ll need to answer a handful of questions to verify your identity.

What phone number is 800 916 8800?

If you’re a consumer with questions or issues related to your personal credit report, drivers history report, disputes, fraud, identity theft, credit report freeze or credit monitoring services, please contact our Consumer Relations Department at 800-916-8800.

Is it better to dispute credit online or by mail? Result: WINNER is mailing your disputes!

Reminder: When they don’t fix the error, you have the proof you need to forced them to fix it and pay you damages IF you send your dispute certified mail. If you dispute it online, you make it difficult to enforce the law and it slows you down.

Do I need to change my address with credit bureaus?

As long as you have open credit accounts, you don’t need to notify Experian that your address has changed. You should provide your new address to each of your creditors, which will in turn update the address on your accounts.

What is the mailing address for the 3 credit bureaus?

How to Contact the Credit Bureaus by Mail: TransUnion: TransUnion Consumer Solutions / P.O. Box 2000 / Chester, PA 19016-2000. Equifax: Equifax Information Services LLC / P.O. Box 740256 / Atlanta, GA 30374. Experian: Experian / P.O. Box 4500 / Allen, TX 75013.

How do I update my Equifax information?

You can update your Email/Username, Mobile Phone, and Password any time within myEquifax by clicking on My Account. Updates to your online account profile are effective immediately.

What is a 609 letter?

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It’s named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices. Written by Natasha Wiebusch, J.D..

Can I call Equifax to dispute?

How to dispute your Equifax report by phone. You can call Equifax at 866-349-5191 and use the automated instructions to request a credit report, place a fraud alert or freeze your credit file. Use the option to speak with an agent to dispute.

What is the correct mailing address for Equifax? By mail to: Equifax Disclosure Department, P.O. Box 740241, Atlanta, GA 30374.

How do I get something removed from my Equifax credit report? If you see information on your Equifax credit report that you believe is inaccurate or incomplete, simply file a dispute, and we’ll look into it right away. Once you’ve submitted a dispute, we’ll investigate and return your results. If we do find that information on your credit report needs to be updated, don’t worry.

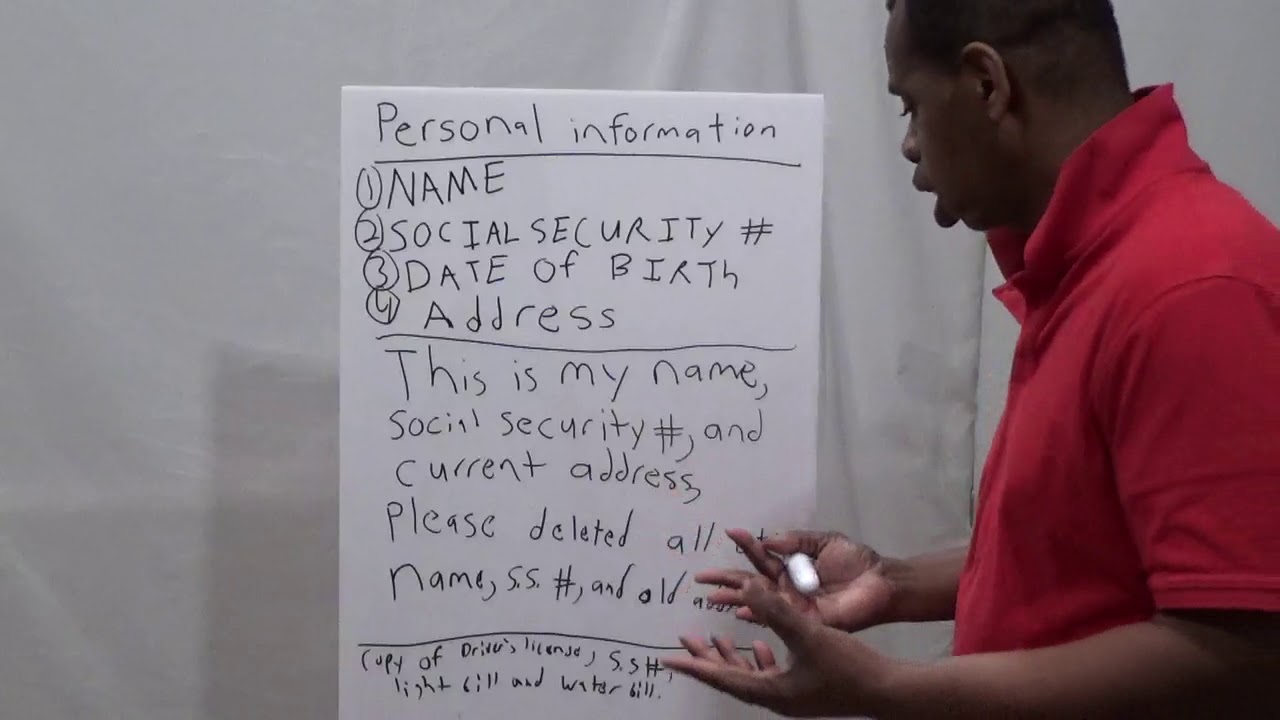

How do I fix incorrect information on my credit report? Ask the credit bureau to remove or correct the inaccurate or incomplete information . Include: your complete name and address. each mistake that you want fixed, and why.

The credit bureaus also accept disputes online or by phone:

- Experian (888) 397-3742.

- Transunion (800) 916-8800.

- Equifax (866) 349-5191.

Why does my information not match credit bureau?

No Record. Incorrect assumptions are the primary reason why the credit bureaus cannot match their personal information. You are not born with a file at the agencies, and data does not magically appear. You have no record until after initiating a borrowing relationship!

Do I have the right to know what’s in my credit report?

Your rights under the Fair Credit Reporting Act:

The copy of your report must contain all of the information in your file at the time of your request. You have the right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Should all 3 credit reports match?

Surprisingly, lenders aren’t required to report to all or any of the three bureaus. While most do, there’s no guarantee that the information will be the same across the board, creating potential differences in your scores.

How do I change my address with credit bureaus?

The answer is …

Instead, get in touch with your creditors and ask them to update your records with your new address, name or employer. When your creditors send their monthly updates to the credit bureaus, they’ll include your new information and your credit reports will be updated.

How do I remove a dispute from my Experian credit report?

To remove disputes from a credit report (for free) you can contact whichever credit bureau is reporting the dispute. Experian’s phone number is 888-397-3742 or a consumer may dispute online. It’s answered by a real-life human being. Just tell them you need the National Consumer Assistance Center to end the dispute(s).

How can I raise my credit score by 100 points in 30 days?

How to improve your credit score by 100 points in 30 days

- Get a copy of your credit report.

- Identify the negative accounts.

- Dispute the negative items with the credit bureaus.

- Dispute Credit Inquiries.

- Pay down credit card balances.

- Do not pay your accounts in collections.

- Have someone add you as an authorized user.

How can I raise my credit score 200 points in 30 days?

How to Raise Your Credit Score by 200 Points

- Get More Credit Accounts.

- Pay Down High Credit Card Balances.

- Always Make On-Time Payments.

- Keep the Accounts that You Already Have.

- Dispute Incorrect Items on Your Credit Report.

How can I raise my credit score 40 points fast? Here are a few tips on how to quickly increase your credit score by 40 points:

- Always make your monthly payments on time.

- Have positive information being reported on your credit report.

- It is imperative to drop credit card debt altogether.

- The last thing you can do is check your credit report for inaccuracies.

What is wrong Equifax?

In September of 2017, Equifax announced a data breach that exposed the personal information of 147 million people. The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories.