Contents

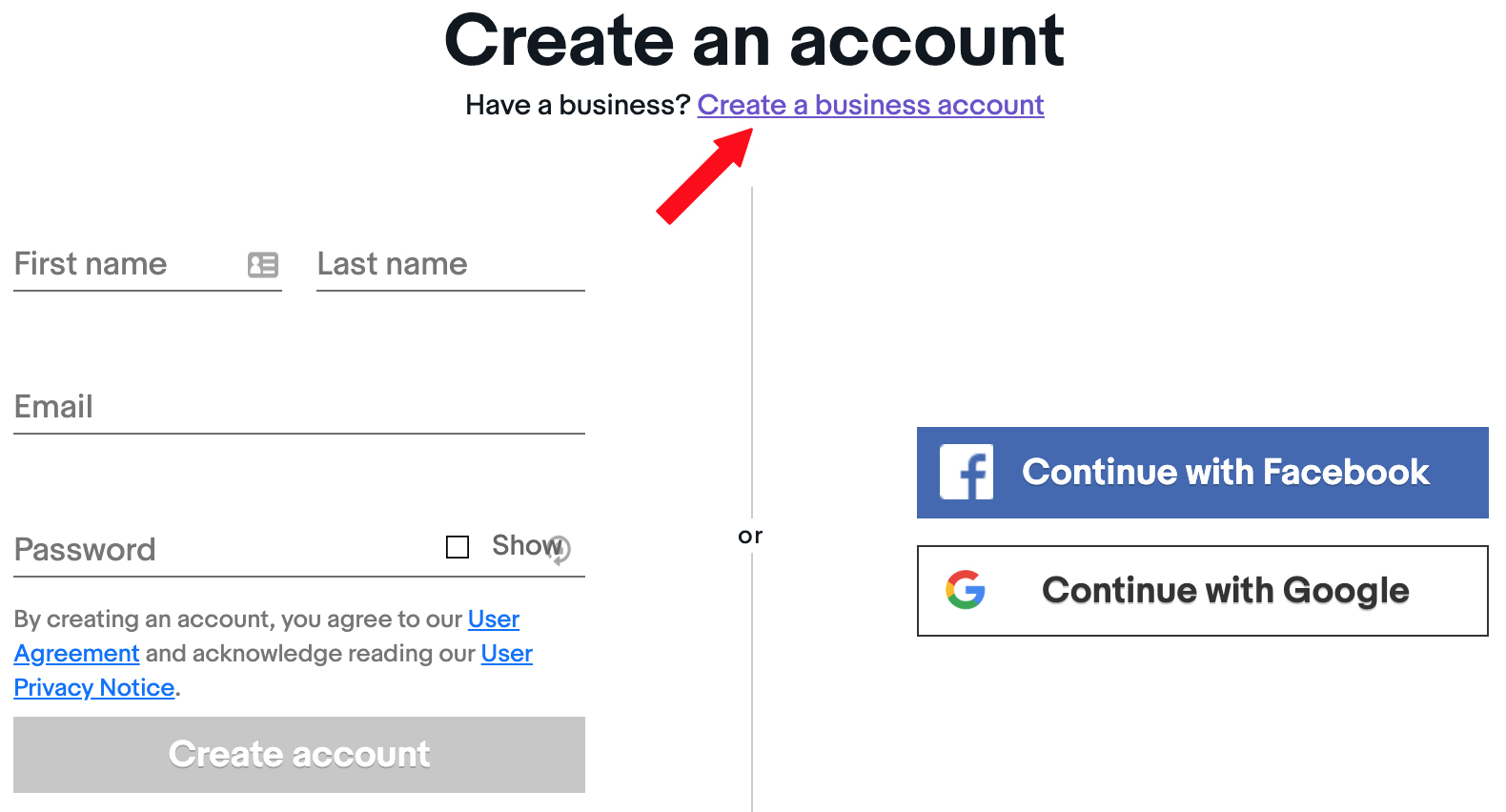

But before you buy and sell on eBay, you’ll need to set up an account. There are two types of eBay accounts. A personal account is best for a casual eBay user. A business account is appropriate for people who plan to sell in large quantities, or for people who have bought or made items specifically to sell..

Can you sell on eBay with a personal account?

Choose your account type

eBay allows you to choose between a personal account and a business account. A personal account is for casual selling, while a business account allows you to sell large quantities of products. You can also register a legal business name and customize your store with your business’s branding.

How much can I sell on eBay without being a business?

In general, as of 2/19/11, eBay does not have a dollar amount that requires you to be a business. The only time eBay factors in your dollar amount is if they consider your powerseller status.

Do I need a business account on eBay?

If you plan to sell casually, such as selling items you no longer want, a private account is the best option. If you want to sell large quantities, if you have items that you’ve made or bought to resell or if you already have a business outside of eBay, you’ll need to register a business account.

Do I have to pay taxes on things I sell on eBay?

No need to worry— you only pay taxes on profits. You won’t owe any taxes on something you sell for less than what you paid for it. For example, if you bought a bike for $1,000 last year and then sold it on eBay today for $700, that $700 you made would generally not be subject to income tax.

How much can you sell on eBay before paying taxes 2022?

Your sales on online marketplaces like eBay are considered reportable income once they are over a certain amount. Because eBay processes payments for these sales, IRS regulations require us to issue a 1099-K for US sellers who sell $20,000 or more in 2021 and $600 or more in 2022.

Why can I only sell 10 items on eBay?

This is to protect customers from the possibility of fraud, or being sold fake or stolen goods. For new eBay sellers, the limit begins at 10 items per month, with a total value of $500. More established sellers who demonstrate credibility can apply to have their eBay selling limits raised.

How much is an eBay store per month?

eBay Store subscription fee per month

| Store type | Store subscription fee per month. Monthly renewal | Store subscription fee per month. Yearly renewal |

|---|---|---|

| Starter | $7.95 | $4.95 |

| Basic | $27.95 | $21.95 |

| Premium | $74.95 | $59.95 |

| Anchor | $349.95 | $299.95 |

Is selling on eBay considered self-employed? Due to the nature of selling on eBay, you’ll file taxes using the 1099 tax form for a self-employed individual. What is a 1099 tax form?

How do I make my eBay account personal?

Go to My eBay and click the Account tab. Click Personal information on the left side of the page. Click Edit next to Account type.

Do I need to register as a business to sell on eBay?

An eBay seller must register as a business if, for example, they sell items they have bought to resell, they make items in order to sell them, or if they buy items for their business.

How many items can you list on eBay without a store?

This is an account-based limit. New sellers have a selling limit: up to 10 items with a total value of up to $500 per month. This means that, during the month, you can list or/and sell up to 10 items for a total of up to $500.

How much can I sell on eBay before paying tax?

If you make up to £1,000 a year from your eBay sales – assuming that they don’t account for your full-time income – this is completely tax-free with the Trading Allowance.

Does selling on eBay count as income?

Your sales on online marketplaces like eBay are considered reportable income once they are over a certain amount. Because eBay processes payments for these sales, IRS regulations require us to issue a 1099-K for US sellers who sell $600 or more.

How much can I make on eBay before paying taxes 2022? As of Jan 1, 2022, the IRS requires eBay to provide you with a Form 1099-K if you receive $600 or more in sales during the 2022 tax year.

Do I have to pay taxes on personal items I sell? Sold goods aren’t taxable as income if you are selling a used personal item for less than the original value. If you flip it or sell it for more than the original cost, you have to pay taxes on the surplus as capital gains.

Does eBay always take 10 %? Short version: eBay takes a percentage of almost all sales, ranging from 1.5% to 15%. eBay’s final value fees are often the largest single cost for sellers. They’re taken as a percentage of the amount actually charged to the customer. That includes the item price, the shipping cost, and any sales tax.

Why can’t I change my eBay account from personal to business?

To change your account type from individual to business:

Go to My eBay > Account > Personal Information. Next to Account Type, click the Edit link. Enter your business name and click the Change to Business Account button.

Do I have to file taxes on eBay sales?

Your sales on online marketplaces like eBay are considered reportable income once they are over a certain amount. Because eBay processes payments for these sales, IRS regulations require us to issue a 1099-K for US sellers who sell $20,000 or more in 2021 and $600 or more in 2022.

Does it cost to sell on eBay?

For most casual sellers, it’s free to list on eBay. If you list more than 250 items per month, you’ll start paying a $0.35 insertion fee per listing.

Is selling on eBay considered self employed?

Due to the nature of selling on eBay, you’ll file taxes using the 1099 tax form for a self-employed individual. What is a 1099 tax form?

Does selling personal items count as income?

Sold goods aren’t taxable as income if you are selling a used personal item for less than the original value. If you flip it or sell it for more than the original cost, you have to pay taxes on the surplus as capital gains.

How much can you sell on eBay before paying taxes 2021?

Your sales on online marketplaces like eBay are considered reportable income once they are over a certain amount. Because eBay processes payments for these sales, IRS regulations require us to issue a 1099-K for US sellers who sell $20,000 or more in 2021 and $600 or more in 2022.

Can I be a sole trader on eBay?

Do I need to register with HMRC? The answer, in the majority of cases, is yes. If you are buying or making products with the intention of selling them on, then you are a sole trader and you need to register for tax self-assessment, which can be done online.

What license do I need to sell on eBay? Facts. Ebay does not require a business license for any of its users, but if you have an eBay store you will likely need a business license — this depends on the statutes of your local government. If you plan to buy items on wholesale instate and resell them on eBay, you need a seller’s permit.

How do you sell on eBay for beginners?

20 Tips for Beginners Selling on Ebay

- Register for an Ebay account.

- Register with PayPal.

- Take high quality pictures.

- List your item under the appropriate category.

- Give your listing the best possible title.

- Give an accurate description of the item you’re selling.

- Set your listing price.

- Set the auction duration.

How can I sell on eBay for free? When you’re just starting out on eBay, you have access to a free seller account—meaning there are no monthly fees to run your business. As you grow your eBay business, you will have the option to create your own eBay Store, a paid monthly subscription offers traffic- and sales-boosting benefits.

How can I avoid paying taxes on eBay?

You cannot avoid paying tax on your eBay activities simply by labelling it your “hobby”, if the reality is that it is more like a business and the motivation is to make a profit. It is also irrelevant whether you are registered as a private seller or as a business on the eBay website.

How much can you sell online before paying tax? Under current rules, individuals who sell goods or services via platforms like Uber, Ebay, Etsy and others that use third-party transaction networks (i.e., PayPal) generally only receive a tax form if they engage in at least 200 transactions worth an aggregate $20,000 or more.

How much can you sell on PayPal before paying taxes? Under the IRC Section 6050W, PayPal is required to report to the IRS the total payment volume received by US account holders whose payments exceed both of these levels in a calendar year: US$20,000 in gross payment volume from sales of goods or services in a single year.