Contents

Credit Karma is not a bank. We partner with MVB Bank, Inc. to provide banking services supporting Credit Karma Money™ Spend and Credit Karma Money™ Save accounts. When you open a Credit Karma Money™ Spend account, your funds will be deposited into an account at MVB Bank, Inc. and its deposit network..

Can I Trust Credit Karma savings?

Is your money safe in a Credit Karma Savings account? It should be noted that Credit Karma isn’t a bank and it has no intention of entering the banking industry . But don’t worry, your money will still be insured by the FDIC up to $5 million.

Is it possible to get a 850 credit score?

An 850 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

How does Credit Karma earn?

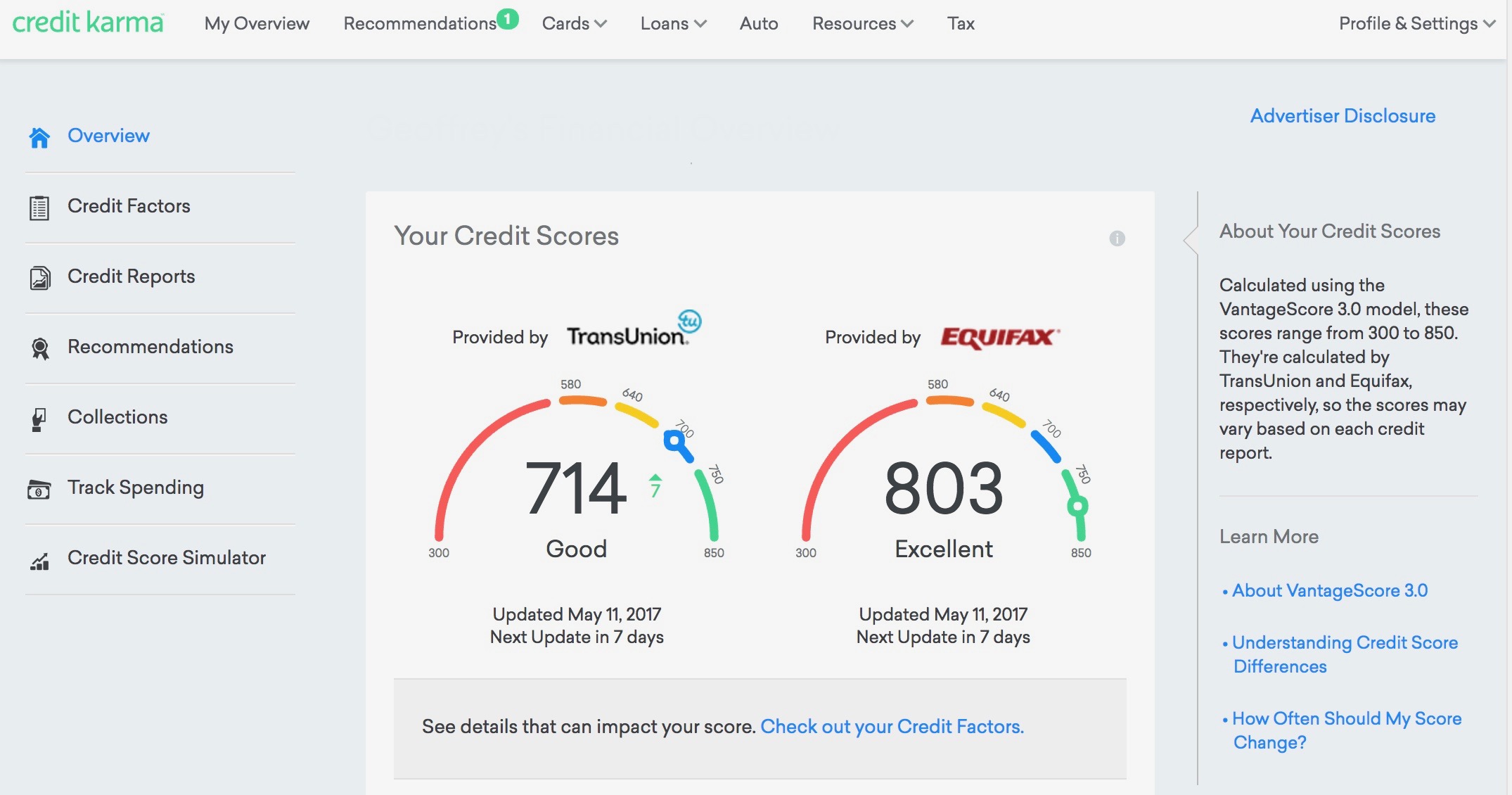

Credit Karma offers free access to TransUnion and Equifax credit data, as well as offering tax preparation assistance, and other services. It makes money by receiving a fee every time a user purchases a product or service it recommends. Credit Karma is a fintech startup focusing on providing credit information.

How long does it take to withdraw money from Credit Karma?

Funds transferred into your Credit Karma Money accounts are not available for immediate withdrawal. The process typically takes 2-3 days.

Can you transfer Credit Karma to Paypal?

We do not currently support transferring funds directly from one Credit Karma member to another but you may be able to do so using your debit card with popular peer-to-peer payment platforms such as Venmo, Paypal, or CashApp.

What is the highest credit score possible?

The best-known range of FICO scores is 300 to 850. Anything above 670 is generally considered to be good. FICO also offers industry-specific FICO scores, such as for credit cards or auto loans, which can range from 250 to 900.

Can you transfer Credit Karma to PayPal?

We do not currently support transferring funds directly from one Credit Karma member to another but you may be able to do so using your debit card with popular peer-to-peer payment platforms such as Venmo, Paypal, or CashApp.

Is CashApp safe? Cash App uses cutting-edge encryption and fraud detection technology to make sure your data and money is secure. Any information you submit is encrypted and sent to our servers securely, regardless of whether you’re using a public or private Wi-Fi connection or data service (3G, 4G, or EDGE).

Can I transfer money from Credit Karma to bank account?

If you’re interested in withdrawing funds from your Credit Karma Money Save account and sending them to your connected bank account, you may do so through the following steps: Access your Credit Karma Money Save account. Select Withdraw. Enter the desired amount under Withdrawal amount.

Can you Zelle with Credit Karma?

Yes, Credit Karma members can use Zelle. It has Zelle integrated into its operations line. Hence, customers can transact funds easier and quicker once they choose Zelle as the transfer option.

What time of day does Credit Karma update?

Updates from TransUnion are usually available through your Credit Karma account every seven days. All you have to do is log in. You’ll see the date of your last update under your personal details on your credit report and you can see when your next update is due at the top of your dashboard.

Can I overdraft my Credit Karma card?

Overdrafting is generally not allowed with your Credit Karma Money Spend account and transactions that exceed your available balance will be declined in most cases.

What bank is cash app through?

Cash App works with two banks – Sutton Bank and Lincoln Savings Bank. To find out exactly which one it is in your case, and to get the account and routing numbers, open the app and tap the routing and account number below your balance in the banking tab (“$”).

Is Credit Karma or Experian more accurate? Experian vs. Credit Karma: Which is more accurate for your credit scores? You may be surprised to know that the simple answer is that both are accurate. Read on to find out what’s different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

Why is my FICO and Credit Karma score different? Your score can then differ based on what bureau your credit report is pulled from since they don’t all receive the same information about your credit accounts. Secondly, different credit score models (and versions) exist across the board.

What is a good credit score to buy a house? Conventional Loan Requirements

It’s recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won’t be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

Does Credit Karma deposit early?

Early Refund

When it’s time to file, have your tax refund direct deposited with Credit Karma Money™, to receive your funds up to 5 days early. 5-day early program may change or discontinue at any time.

Is a 900 credit score possible?

FICO® score ranges vary — they can range from 300 to 850 or 250 to 900, depending on the scoring model — but higher scores can indicate that you may be less risky to lenders.

Is a 750 FICO score good?

Your FICO® Score falls within a range, from 740 to 799, that may be considered Very Good. A 750 FICO® Score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders’ better interest rates and product offers.

What’s considered a+ credit?

A or A+ Credit Tier (700-739 or 740-877)

A+ credit usually shows at least 5 years of good credit, current or prior well paid auto loans, and low balances on revolving credit.

Why is Credit Karma not accurate?

If your Credit Karma score isn’t accurate, the problem is probably elsewhere. That is, one of the bureaus made an error or omitted information. Or, the information might have been reported to one bureau but not others.

Is Credit Karma selling my information?

Credit Karma is always free. Credit Karma won’t ask you for your credit card number during the registration process or at any other time. We don’t ever sell your information. We do get paid through our partners if you get a product through one of our recommendations.

What is a good credit score?

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Can I take money off my Credit Karma card at Walmart? Your Credit Karma Visa® Debit Card only provides direct access to funds in your Credit Karma Money Spend account. You will not be able to withdraw cash at an ATM or spend directly from your Credit Karma Money Save account.