Contents

If you want to remove an address you’ve previously lived at from your credit report please click “Do you still have questions” below and provide us with the details of the address you wish to remove. We’ll also need you to provide your credit report reference number so we can locate the correct information..

How do I remove an old address from Credit Karma?

Log into Credit Karma. On a browser, hover over Profile and Settings. Select personal information from the drop-down menu. Enter or select from the drop-down menu your new information, and click Save.

How do I change my Equifax credit report address?

Equifax: If you would like to update your address directly with the agency, send a letter stating your new address to Equifax at the address on your credit report, along with two qualifying documents.

Why is there an address on my credit report that I have never lived at?

Your credit report may list any address associated with an account with which you are associated. This means that if you are a joint account holder or an authorized user on an account and the bills are sent to someone else’s address, that address could appear on your report as well.

Why does my information not match credit bureau?

No Record. Incorrect assumptions are the primary reason why the credit bureaus cannot match their personal information. You are not born with a file at the agencies, and data does not magically appear. You have no record until after initiating a borrowing relationship!

Do I need to change my address with credit bureaus?

As long as you have open credit accounts, you don’t need to notify Experian that your address has changed. You should provide your new address to each of your creditors, which will in turn update the address on your accounts.

How do I change my address with credit bureaus?

The answer is …

Instead, get in touch with your creditors and ask them to update your records with your new address, name or employer. When your creditors send their monthly updates to the credit bureaus, they’ll include your new information and your credit reports will be updated.

Can you talk to someone at Credit Karma?

Reach out to Penny on the Credit Karma Mobile App: Tap Credit on the top menu. From the Credit Health page, tap Chat with Penny.

Should all 3 credit reports match? Surprisingly, lenders aren’t required to report to all or any of the three bureaus. While most do, there’s no guarantee that the information will be the same across the board, creating potential differences in your scores.

How do I get something removed from my Equifax credit report?

If you see information on your Equifax credit report that you believe is inaccurate or incomplete, simply file a dispute, and we’ll look into it right away. Once you’ve submitted a dispute, we’ll investigate and return your results. If we do find that information on your credit report needs to be updated, don’t worry.

What is Experian dispute mailing address?

By mail: You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013.

What is a goodwill request for deletion?

The goodwill deletion request letter is based on the age-old principle that everyone makes mistakes. It is, simply put, the practice of admitting a mistake to a lender and asking them not to penalize you for it. Obviously, this usually works only with one-time, low-level items like 30-day late payments.

How do you ask for goodwill deletion?

If your misstep happened because of unfortunate circumstances like a personal emergency or a technical error, try writing a goodwill letter to ask the creditor to consider removing it. The creditor or collection agency may ask the credit bureaus to remove the negative mark.

How do I remove a dispute from my Experian credit report?

To remove disputes from a credit report (for free) you can contact whichever credit bureau is reporting the dispute. Experian’s phone number is 888-397-3742 or a consumer may dispute online. It’s answered by a real-life human being. Just tell them you need the National Consumer Assistance Center to end the dispute(s).

Do goodwill letters work? Goodwill letters still work.

It’s really not an issue you can dispute unless there was a mistake reported to the credit bureaus. Keep your cool and be patient because goodwill is just that — A goodwill gesture extended by the creditor.

What is a pay for delete? Pay for delete is when a borrower agrees to pay off their collections account in exchange for the debt collector erasing the account from their credit report. Accounts that are sent to collections typically stay on a consumer’s credit report for seven years from the date of first delinquency.

How many points will my credit score increase if a collection is deleted? If its the only collection account you have, you can expect to see a credit score increase up to 150 points. If you remove one collection and you have five total, you may not see any increase at all–you’re just as much of a risk with 4 collections as 5.

What is a 609 letter?

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It’s named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices. Written by Natasha Wiebusch, J.D..

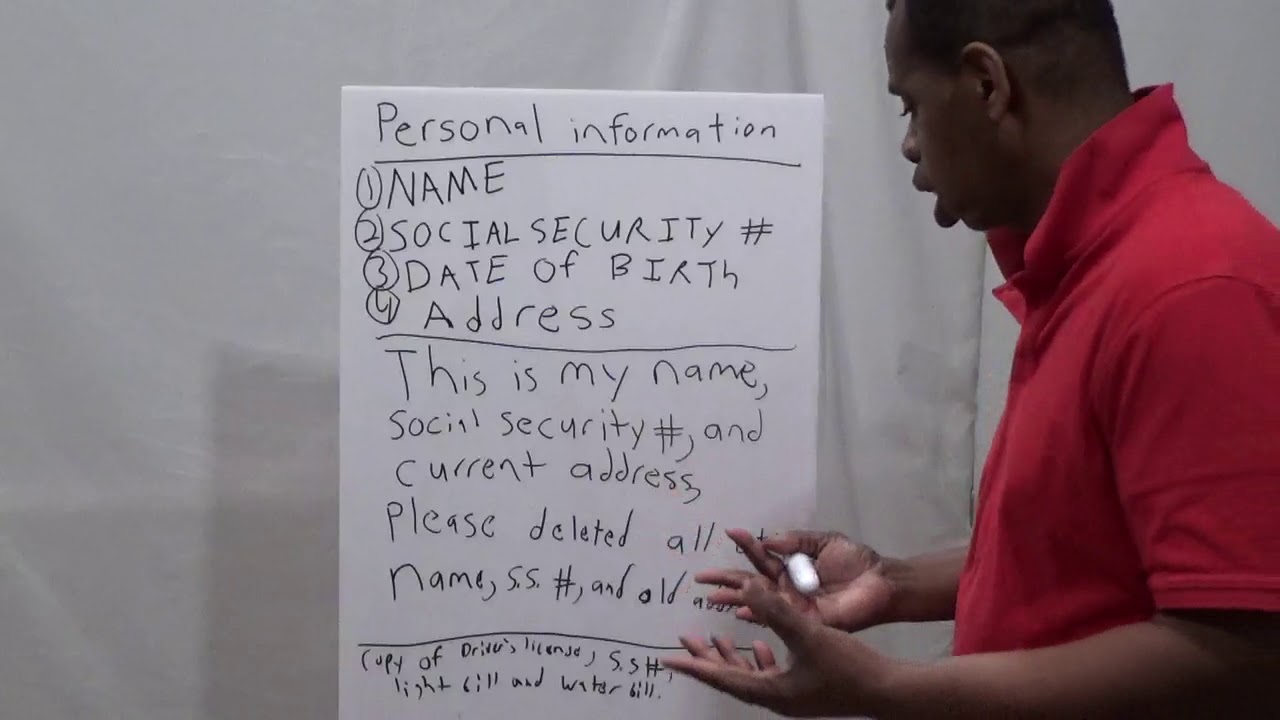

How do you write a goodwill deletion letter?

The following are important details to include in the goodwill letter:

- The date.

- Your name.

- Your address.

- Your creditor’s name.

- Your creditor’s address.

- Your account number.

- The negative mark you’d like removed.

- Which credit bureaus the mark needs to be removed from.

What is the 11 word credit loophole?

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again – by telling them ’11-word phrase’. This simple idea was later advertised as an ’11-word phrase to stop debt collectors’.

What is a 611 letter?

Here’s what you need to know: The Fair Credit Reporting Act’s (FCRA) Section 611 allows for consumers to challenge questionable items on their credit reports. This includes late payments charge-offs, collections, tax liens, bankruptcies, judgments, foreclosures, or any personal identification information.

What is a 623 dispute letter?

The name 623 dispute method refers to section 623 of the Fair Credit Reporting Act (FCRA). The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the credit bureau and completed their process.

What is the mailing address for the 3 credit bureaus?

How to Contact the Credit Bureaus by Mail: TransUnion: TransUnion Consumer Solutions / P.O. Box 2000 / Chester, PA 19016-2000. Equifax: Equifax Information Services LLC / P.O. Box 740256 / Atlanta, GA 30374. Experian: Experian / P.O. Box 4500 / Allen, TX 75013.

How do I update my address with TransUnion?

To add a new address to your credit report, contact us at (800) 916-8800 or mail us copies of two (2) documents that show your new address.

How long does it take Equifax to update credit report? If you file a dispute regarding information on your Equifax credit report, you can generally expect to receive the results of the investigation within 30 days. If the information on your credit report is found to be inaccurate or incomplete, your credit report will be updated, generally within about 30 days.