Contents

There is no way to delete your Credit Karma account. However, you can deactivate it by logging in and going to “Settings.” Then, under “Account Preferences,” click the “Deactivate Account” link..

Does Credit Karma hurt your credit?

Checking your free credit scores on Credit Karma doesn’t hurt your credit. These credit score checks are known as soft inquiries, which don’t affect your credit at all.

Should I give my SSN to Credit Karma?

In order to confirm your identity, you will need to confirm your full Social Security Number to open a Credit Karma Money Spend or Save account. Your full SSN is required to be collected under the Customer Identification Program (CIP) of the USA PATRIOT Act when opening a new savings account.

What is better Credit Karma or Experian?

Credit Karma is a user-friendly website that offers free Vantage 3.0 scores from TransUnion and Equifax. Experian offers free access to credit scores and credit reports through various free product suites, as well as paid score and report options.

Is 650 a good credit score?

A FICO® Score of 650 places you within a population of consumers whose credit may be seen as Fair. Your 650 FICO® Score is lower than the average U.S. credit score. Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

Is Credit Karma actually accurate?

The credit scores and credit reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. They should accurately reflect your credit information as reported by those bureaus — but they may not match other reports and scores out there.

What site has the most accurate credit score?

Best Overall AnnualCreditReport.com

The Consumer Financial Protection Bureau confirms that AnnualCreditReport.com is the official website that allows you to access each of your credit reports from all three of the major credit bureaus — Equifax, Experian, and TransUnion — at no cost.

Can I buy a house with a 652 credit score?

If your credit score is a 652 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. There are many mortgage lenders that offer loan programs to borrowers with credit scores in the 500s.

What is a Good credit score to buy a house? Conventional Loan Requirements

It’s recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won’t be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

How do you change your email on Credit Karma?

On desktop or mobile web:

- Log into your Credit Karma account.

- In the upper right corner, hover over Profile and Settings and click on Security Settings.

- Scroll down to the Change Email section and click Edit.

- Type in your new email address twice as well as your password in the corresponding fields.

- Click Update.

Why can’t Credit Karma verify my information?

If you are seeing this error, please ensure that the address you are using is correct and is formatted exactly as it appears on mail you receive at that address. If we are unable to validate your address you may not be able to open a Credit Karma Money Spend or Save account at this time.

Is there a customer service number for Credit Karma?

If you notice activity on your Credit Karma Money Save account that you do not recognize or that you believe is an error, you should contact us or call (888) 315-3267 to report the issue as soon as possible.

Can you talk to someone at Credit Karma?

Reach out to Penny on the Credit Karma Mobile App: Tap Credit on the top menu. From the Credit Health page, tap Chat with Penny.

What credit score is needed to buy a house with no money down?

No down payment is required for VA, USDA and doctor loan programs detailed above. What credit score do I need to buy a house with no money down? No-down-payment lenders usually set 620 as the lowest credit score to buy a house.

Why won’t Credit Karma take my address? For your security, your home address needs to be verified with TransUnion and Equifax before you can update it on Credit Karma. If the credit reports that Credit Karma receives from the credit bureaus don’t include your current address, then the option won’t appear in the drop-down menu.

How do I verify my identity? To verify their identity with ID.me, taxpayers need to provide a photo of an identity document such as a driver’s license, state ID or passport. They’ll also need to take a selfie with a smartphone or a computer with a webcam.

What bank is Credit Karma?

Credit Karma is not a bank. We partner with MVB Bank, Inc. to provide banking services supporting Credit Karma Money™ Spend and Credit Karma Money™ Save accounts. When you open a Credit Karma Money™ Spend account, your funds will be deposited into an account at MVB Bank, Inc. and its deposit network.

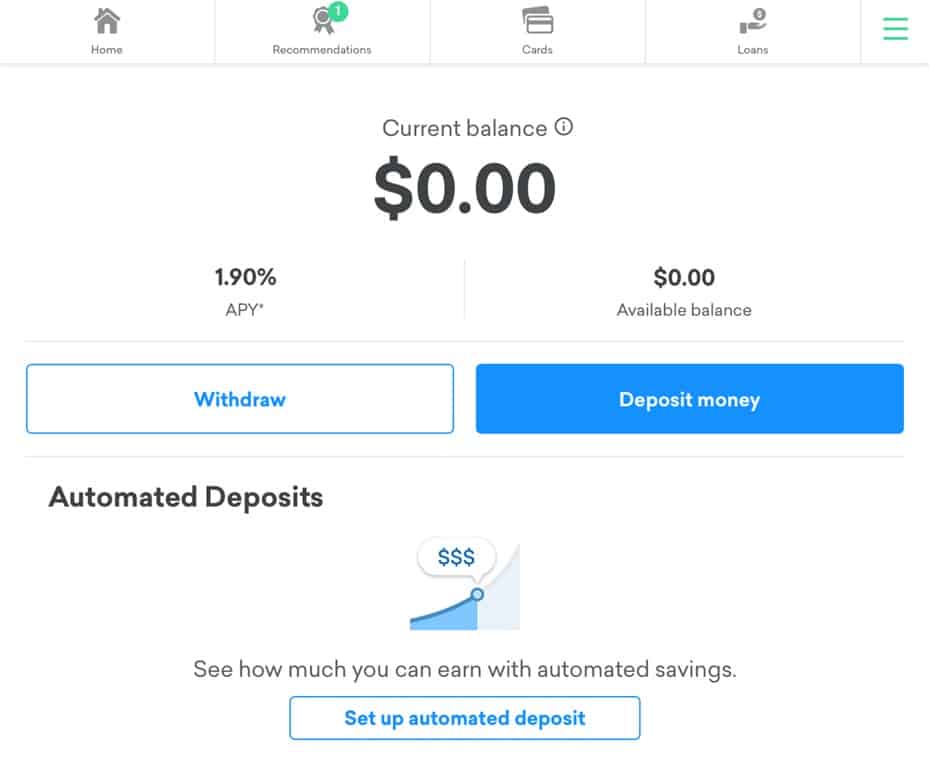

Can I transfer money from Credit Karma to my bank account?

If you’re interested in withdrawing funds from your Credit Karma Money Save account and sending them to your connected bank account, you may do so through the following steps: Access your Credit Karma Money Save account. Select Withdraw. Enter the desired amount under Withdrawal amount.

Can I link my Credit Karma account to Cash App?

We do not currently support transferring funds directly from one Credit Karma member to another but you may be able to do so using your debit card with popular peer-to-peer payment platforms such as Venmo, Paypal, or CashApp.

How do I contact Credit Karma by phone?

If you notice activity on your Credit Karma Money Save account that you do not recognize or that you believe is an error, you should contact us or call (888) 315-3267 to report the issue as soon as possible.

What is the downside of Credit Karma?

If there’s a downside to Credit Karma, it’s the fact that, yes, they’re using your personal credit data to advertise to you. It’s no different than Facebook using your likes to serve ads based on your interests. That said, I would agree that the financial data makes it a bit more personal.

Does Credit Karma sell my information?

Credit Karma is always free. Credit Karma won’t ask you for your credit card number during the registration process or at any other time. We don’t ever sell your information. We do get paid through our partners if you get a product through one of our recommendations.

Why does it say my SSN is wrong on Credit Karma?

While an incorrect Social Security number (SSN) on your report could be a sign of fraud, usually it is simply the result of a typographical error or a misread credit application form.

Why Credit Karma is not accurate? If your Credit Karma score isn’t accurate, the problem is probably elsewhere. That is, one of the bureaus made an error or omitted information. Or, the information might have been reported to one bureau but not others.