Contents

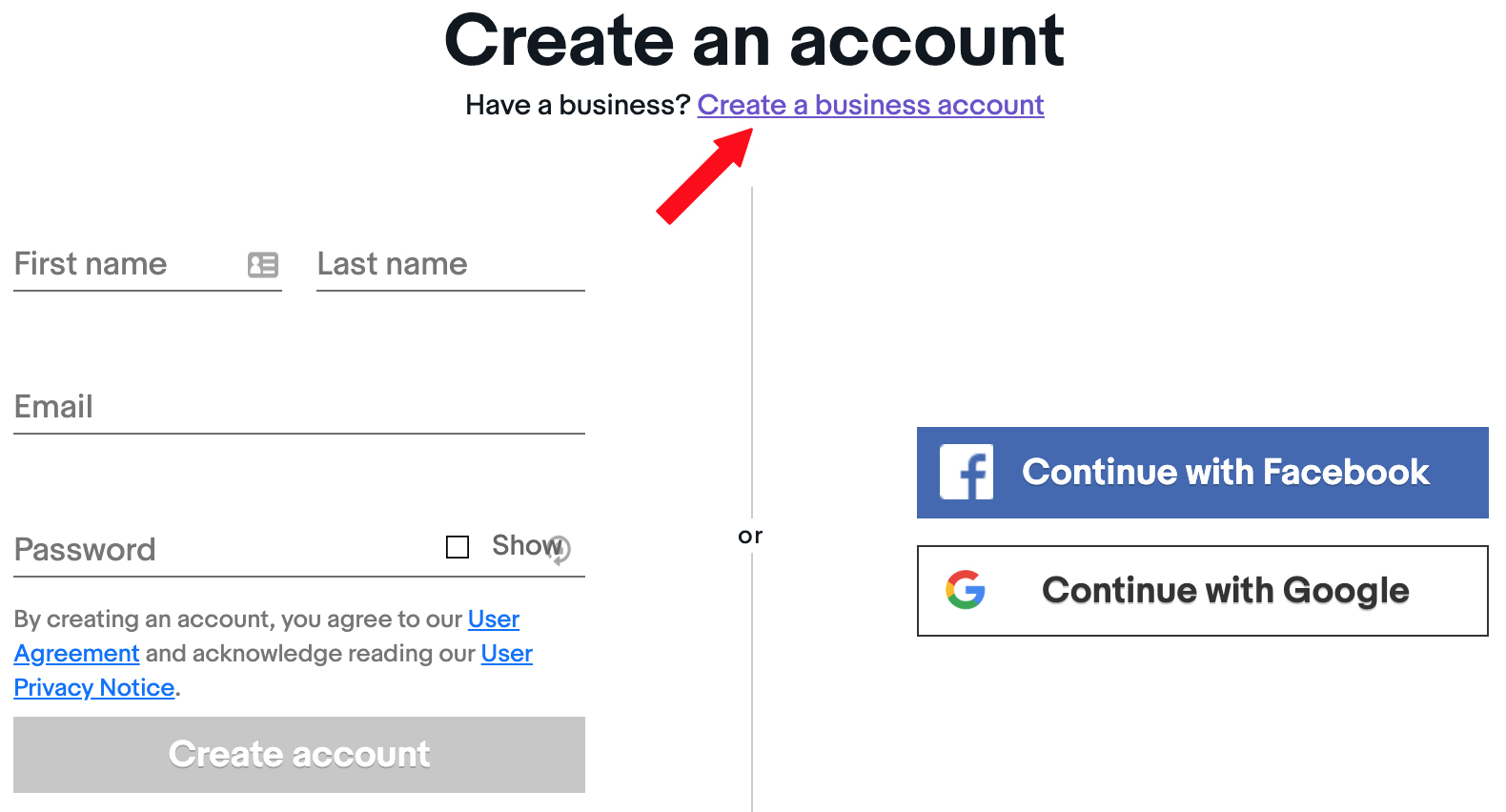

If you plan to sell casually, such as selling items you no longer want, a private account is the best option. If you want to sell large quantities, if you have items that you’ve made or bought to resell or if you already have a business outside of eBay, you’ll need to register a business account..

Can I have 2 eBay accounts with the same email address?

For each new eBay account, you need a different email address. You can’t use the same email on multiple eBay accounts.

Does it cost to sell on eBay?

For most casual sellers, it’s free to list on eBay. If you list more than 250 items per month, you’ll start paying a $0.35 insertion fee per listing.

Is selling on eBay considered self-employed?

Due to the nature of selling on eBay, you’ll file taxes using the 1099 tax form for a self-employed individual. What is a 1099 tax form?

Do I need a license to sell on eBay?

For most items ebay does not require any kind of licence. However you will have to check your local business licence laws. Certain items however are more heavily regulated such as food, alochol or children’s toys. In many ways, growing an eBay business is just like growing any other ecommerce business.

Can I make 1000 a month on eBay?

After setting up a store and putting in a little more time I was able to start bringing in over $1,000 per month on eBay (and often more), all for just an hour or two of work every couple of days!

Is it illegal to resell items on eBay?

Generally, it’s not illegal to resell an item that you have legitimately purchased. Once you have purchased something at retail it is yours to do with as you choose. Manufacturers tend to have little or no control over a product past the first customer they sell to.

Can I sell on eBay without PayPal?

The short answer is no, you don’t need a PayPal account to sell on eBay. In fact, eBay phased out PayPal from the site last year, in favor of their own ‘Managed Payments System’. For as long as most people can remember, users have needed a PayPal account to be able to have an eBay seller account.

How much is an eBay store per month? eBay Store subscription fee per month

| Store type | Store subscription fee per month. Monthly renewal | Store subscription fee per month. Yearly renewal |

|---|---|---|

| Starter | $7.95 | $4.95 |

| Basic | $27.95 | $21.95 |

| Premium | $74.95 | $59.95 |

| Anchor | $349.95 | $299.95 |

How much can I sell on eBay before paying tax?

If you make up to £1,000 a year from your eBay sales – assuming that they don’t account for your full-time income – this is completely tax-free with the Trading Allowance.

Do I need to register as a business to sell on eBay?

An eBay seller must register as a business if, for example, they sell items they have bought to resell, they make items in order to sell them, or if they buy items for their business.

Is selling on eBay considered self employed?

Due to the nature of selling on eBay, you’ll file taxes using the 1099 tax form for a self-employed individual. What is a 1099 tax form?

How much can I make on eBay before paying taxes 2022?

As of Jan 1, 2022, the IRS requires eBay to provide you with a Form 1099-K if you receive $600 or more in sales during the 2022 tax year.

What license do you need to sell things on eBay?

The only requirement for eBay users is a business license, but if you own an eBay store, you will likely need one — depending on your local government’s laws. If you do not have this permit, you must pay sales tax on wholesale purchases.

What are the benefits of an eBay business account? Pros

- Higher Selling Limits. eBay places selling limits on new sellers, which can be as strict as a maximum of 10 items per month when you first open an individual account.

- Access to Better Tools & Promotions.

- Lower Taxes.

- The Ability to Use Your Company Name.

- Legal Protection.

- Greater Selling Privileges in Crisis Situations.

How much can you sell on PayPal before paying taxes? Under the IRC Section 6050W, PayPal is required to report to the IRS the total payment volume received by US account holders whose payments exceed both of these levels in a calendar year: US$20,000 in gross payment volume from sales of goods or services in a single year.

Do I have to file taxes on eBay sales?

Your sales on online marketplaces like eBay are considered reportable income once they are over a certain amount. Because eBay processes payments for these sales, IRS regulations require us to issue a 1099-K for US sellers who sell $20,000 or more in 2021 and $600 or more in 2022.

Do I have to pay taxes on personal items I sell?

Sold goods aren’t taxable as income if you are selling a used personal item for less than the original value. If you flip it or sell it for more than the original cost, you have to pay taxes on the surplus as capital gains.

How do I avoid eBay fees?

7 Ways to Reduce Your eBay Seller Fees

- Open an eBay Store and Pay an Annual Subscription.

- Take Advantage of Zero Insertion Fees.

- Become a Top-Rated Seller (TRS)

- Reduce Your Optional Upgrades.

- Request Credits Due for Final Value Fees.

- Claim Non-Paying Bidder Insertion Credits.

- Make Sure you Have a PayPal Merchant Account.

Does eBay always take 10 %?

Short version: eBay takes a percentage of almost all sales, ranging from 1.5% to 15%. eBay’s final value fees are often the largest single cost for sellers. They’re taken as a percentage of the amount actually charged to the customer. That includes the item price, the shipping cost, and any sales tax.

How do you sell on eBay for beginners?

20 Tips for Beginners Selling on Ebay

- Register for an Ebay account.

- Register with PayPal.

- Take high quality pictures.

- List your item under the appropriate category.

- Give your listing the best possible title.

- Give an accurate description of the item you’re selling.

- Set your listing price.

- Set the auction duration.

How can I avoid paying taxes on eBay?

You cannot avoid paying tax on your eBay activities simply by labelling it your “hobby”, if the reality is that it is more like a business and the motivation is to make a profit. It is also irrelevant whether you are registered as a private seller or as a business on the eBay website.

Do I have to pay taxes on selling personal items?

Sold goods aren’t taxable as income if you are selling a used personal item for less than the original value. If you flip it or sell it for more than the original cost, you have to pay taxes on the surplus as capital gains.

How much can you sell online before paying tax? Under current rules, individuals who sell goods or services via platforms like Uber, Ebay, Etsy and others that use third-party transaction networks (i.e., PayPal) generally only receive a tax form if they engage in at least 200 transactions worth an aggregate $20,000 or more.