Contents

If you’ve already submitted your tax return and it was accepted, you cannot change your routing and account number. Refunds that were scheduled for direct deposit will be sent back to the IRS if you provided incorrect account/routing numbers or if the account is closed. You will then be mailed a paper refund check..

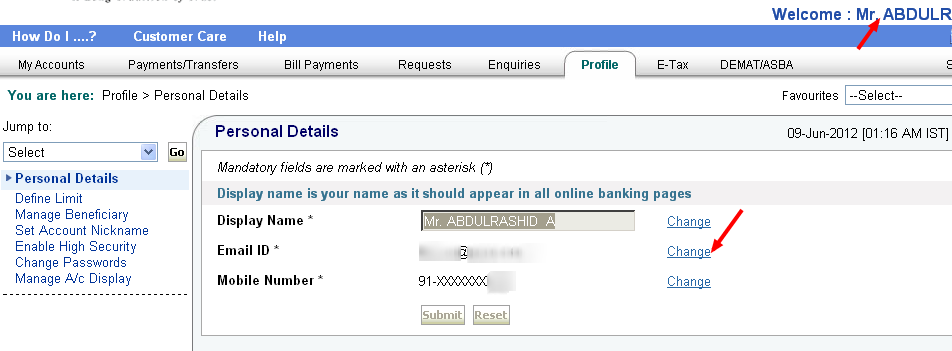

Can I change my number in bank account online?

Any resident retail Internet Banking account holder having active ATM cum Debit card and which is mapped with internet banking can change his or her mobile number entirely online without visiting branch.

Can someone take money out of my bank account with my account number?

A bank routing number typically isn’t enough to gain access to your checking account, but someone may be able to steal money from your account if they have both your routing number and account number.

What can someone do with your bank account number?

Things Someone Can Do With Your Bank Account And Routing Number

- Send your money using your bank account and routing number.

- Commit ACH fraud using your bank account and routing number.

- Create fraudulent checks using your bank account and routing number.

What if a scammer has my bank details?

Contact the company or bank that issued the credit card or debit card. Tell them it was a fraudulent charge. Ask them to reverse the transaction and give you your money back.

Can someone steal your money with your bank details?

Phishing scams are attempts by scammers to trick you into giving out your personal information such as your bank account numbers, passwords and credit card numbers.

Do banks refund scammed money?

If you paid by bank transfer or Direct Debit

Contact your bank immediately to let them know what’s happened and ask if you can get a refund. Most banks should reimburse you if you’ve transferred money to someone because of a scam.

Do I get my money back if my bank account is hacked?

Banks are liable

If a hacker steals money from a bank, the customer won’t lose money since the bank is liable to refund money for fraudulent debit transactions. However, it’s important to report fraud as soon as possible, as the bank’s liability decreases over time.

How do fraudsters get your bank details? A common method fraudsters use to steal bank details is through attaching ‘skimming’ devices onto ATM machines. The device works by reading and lifting information from the magnetic strip on the back of the card when it is inserted into the machine.

Can you get a different bank account number?

Account numbers are unique to a specific financial account. Clients may hold multiple accounts, each with a different account number, while the routing number (i.e., the financial institution that holds the customer’s account) remains the same.

Can someone empty your bank account?

Someone can empty your bank account with the information on the front of every check you write.

Can a scammer access my bank account?

Scammers take advantage of the fact that you’re already on the phone with them to make it seem like the code is part of how they’re verifying your identity. In reality, they’re triggering a process that will allow them reset your password and gain access to your online banking account.

Can someone hack your bank account?

Completing banking transactions through your computer, table, or smartphone in public can put your bank account information at risk. Banks do their best to encrypt the data that is transmitted, but hackers may still be able to retrieve your login information to use at a later date.

How do I know if my bank account is being monitored?

5 Ways You Can Tell If Your Bank Account Has Been Hacked

- Small unexplained payments.

- Unexpected notifications from your bank.

- A call claiming to be your bank demands information.

- Large transactions empty your bank account.

- You learn your account has been closed.

Can someone steal your direct deposit? Direct deposit offers fewer opportunities for fraud. Someone can’t, for example, steal a direct deposit and put it in their own account as they might be able to do with a paper check or cash payment.

What happens if someone steals money from your checking account? If Your Card or Pin Were Lost/Stolen

If you notify your bank or credit union after the two business days, you could be on the hook for up to $500 in authorized transactions. The same rules apply if you had cash taken directly out of your account as a result of a stolen PIN or security code.

Can someone hack your bank account with your name and email? Your online bank accounts can also be a major target for hackers, especially if you use your email address as a login for those, too. And, needless to say, once a hacker has access to those, your money is in serious jeopardy. “This is one of the biggest risks you’ll face from an email hack,” Glassberg says.

Does your bank account number change when you get a new card?

Your account and routing numbers to your checking account will not change with a debit card replacement. To find those numbers, simply look on your bank statement each month or on the bottom of your checkbook.

What can a scammer do with my bank account number and routing number?

When a scammer has your bank account and routing numbers, they could set up bill payments for services you’re not using or transfer money out of your bank account. It’s tough to protect these details because your account number and routing number are hiding in plain sight at the bottom of your checks.

Can someone withdraw money with account number and sort code?

It’s generally considered safe to give out your account number and sort code, but you should always use common sense and avoid sharing your bank details with people you don’t know or expect payments from.

Do banks refund money if scammed?

Contact your bank immediately to let them know what’s happened and ask if you can get a refund. Most banks should reimburse you if you’ve transferred money to someone because of a scam.

What details do fraudsters need?

Fraudsters need just three pieces of personal information to steal your identity, most of which can be found on your Facebook profile. All it takes is your name, date of birth and address for fraudsters to steal your identity and access your bank accounts, take out loans or take out mobile phones in your name.

How can I find out if someone is using my identity?

What you can do to detect identity theft

- Track what bills you owe and when they’re due. If you stop getting a bill, that could be a sign that someone changed your billing address.

- Review your bills.

- Check your bank account statement.

- Get and review your credit reports.

How do fraudsters get caught?

Fraud is most commonly detected through employee tips, followed by internal audit, management review and then accidental discovery; external audit is the eighth most common way that occupational frauds are initially detected.

What information does a scammer need? Much like a Social Security number, a thief only needs your name and credit card number to go on a spending spree. Many merchants, particularly online, also ask for your credit card expiration date and security code. But not all do, which opens an opportunity for the thief.

What bank details should you never give out?

It’s important you never give anyone your card’s PIN, the three-digit security number on the back of your card or any online passwords, as this is where things can get messy. You should never give these out to a single person.

What to do if you give your bank details to a scammer? Reporting fraud. If you’ve given a fraudster your bank details, you must contact your bank immediately and explain that you’re the victim of a fraud. Explain exactly what’s happened and give your bank as much detail as possible. Your bank should act in your best interest and should refund your money.

What bank is sort code 040075?

Bank Sort Code Examples

| Sort Code | Institution Name |

|---|---|

| 040075 | Modulr Finance (Revolut) |

| 040026 | N26 Bank |

| 087199 | Aps Financial |

| 608371 | Starling Bank |