Contents

How long does Ally Financial take to repossess my car? Repossession law varies slightly from state to state and range from 3 to 5 months after you stopped making payments on your Ally Financial loan..

Does ally have a grace period?

Generally, the grace period for an auto loan is 10 days. However, this period will depend on the lender. Unfortunately, details regarding Ally Bank’s auto loan grace period are not made available on the website. Please call customer service at 888-925-2559 for more details.

Can I refinance my car with Ally?

Ally Clearlane, part of Ally Financial Inc., is a direct lender that offers loans for refinancing your existing auto loan as well as buying out your leased vehicle. It does not offer auto purchase loans.

Can you skip a payment on a car loan?

Under a car loan deferment, the lender agrees to let you pay a lower payment or no payment at all for a month—or two, or three, but probably not much longer than that—with the expectation that you’ll be able to resume your regular payment schedule after the deferment ends.

Does skip a payment hurt credit?

The good news is that accepting an offer to skip your payments won’t negatively affect your credit. As long as you make any upcoming payments as required by the lender, your credit will show that you’re paying as agreed. There are two main types of skip-payment plans: deferment and forbearance.

Can I get an extension on my car payment?

Reach out to your lender and ask questions until you understand their requirements. In general, a payment extension allows you to defer a certain number of monthly payments—usually one or two—until a later date, providing a brief break for borrowers suffering unexpected financial hardships or a natural disaster.

What is one disadvantage of using a skip payment option?

General Consequences of Skipping Monthly Payments

Whenever you miss a payment, you can count on being charged a late fee. When your next bill is due, you’ll have to make two months of payments plus the late fee. Because of that catching up can be difficult and it’s more difficult the higher your monthly payments are.

How does skip a payment work?

A skip-payment mortgage is a home loan product that allows a borrower to skip one or more payments without any penalty. The interest accrued during the skipped periods will instead be added to the principal, and monthly payments will then be recalculated once they resume.

What payments can be deferred? Deferred expenses are items you prepay in advance. This can include paying your rent or mortgage before your payments are due. Do not report deferred expenses on your income statement. Record the deferred expenses as assets on your balance sheet when you incur the expenses.

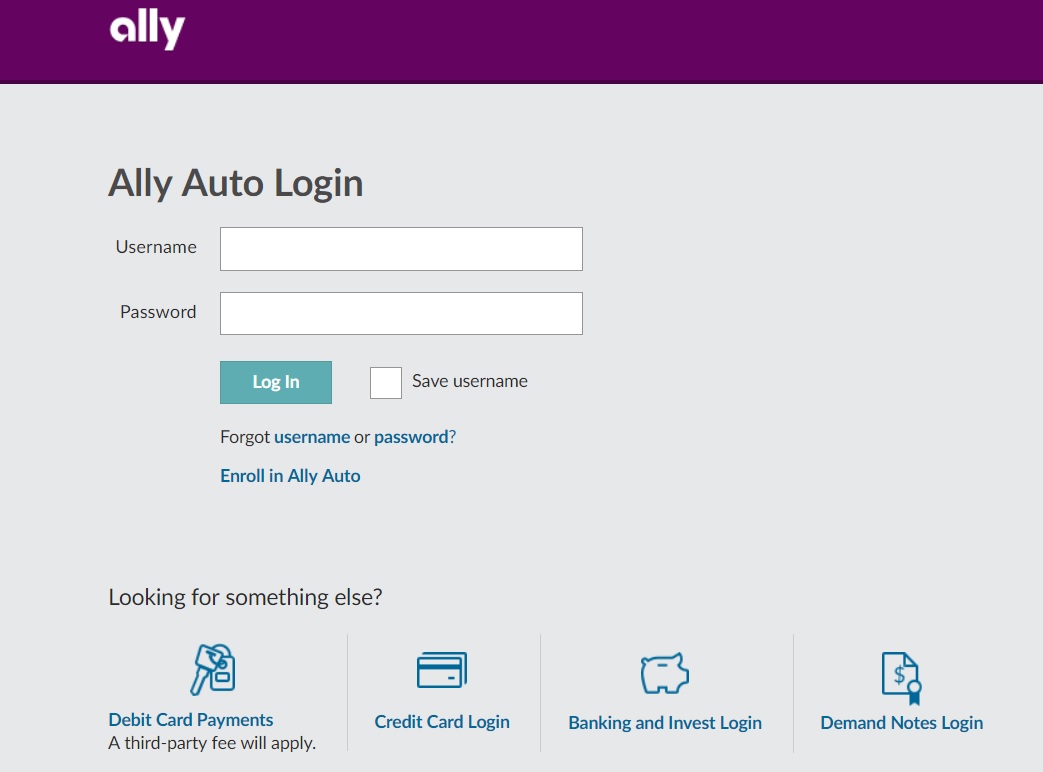

Can I change my due date with Ally Auto?

Can I change the payment due date for my accounts? Yes, you can change the payment date for your accounts. Keep in mind there may be fees applied depending on your contract details and if additional accounts are added to your consolidated statement.

Can you defer a car payment?

Auto loan deferment is when your lender agrees to let you pay a lower loan payment or not make a payment for a certain time period. Lenders sometimes refer to this as a loan extension or postponement. Not every auto lender allows deferments, and those that do may have different criteria for approving one.

How many days can you be late on your car payment?

Car Loan Payment Grace Period

Grace periods for a car loan will vary depending on the lender, but most banks give a 10-day grace period before counting a payment as late. After that, you’ll likely incur a late fee.

Can you ask for an extension on a car payment?

Reach out to your lender and ask questions until you understand their requirements. In general, a payment extension allows you to defer a certain number of monthly payments—usually one or two—until a later date, providing a brief break for borrowers suffering unexpected financial hardships or a natural disaster.

What happens if you can’t make a car payment?

If you can’t resume payments and get caught up, your car can be repossessed. Worse, you could still owe money on your former car after you no longer have it. The repercussions can stick with your credit rating for years, making it hard to borrow money again, and increasing the interest on any loan you do get.

What happens if you miss 1 car payment? The short answer is yes: skipping one car payment can hurt your credit score, but not until it hits a certain mark. One missed payment doesn’t destroy your credit score forever, but it can stay on your credit reports for years.

Can I be 2 weeks late on a car payment? There is usually a grace period for car loan payments so you should be fine. I wouldn’t worry about any late fees, and there shouldn’t be any impact on your credit. The grace period should be about a week or two. After that, you will be charged a fee of around $30.

What happens if I miss my car payment by one day? No. A one-day-late payment does not affect a credit score. A late payment won’t be reported to the credit bureaus until it is 30 days past-due – meaning a second due date has passed. This could also trigger a loan to default, depending on the type of loan and the agreed upon terms.

Does Ally report to credit bureaus?

Ally Financial — like most lenders — reports to credit bureaus once per month.

Is there a 10 day grace period for car payments?

How Many Days Is the Grace Period for Car Payments? In general, a grace period for a car payment is 10 days past the payment due date. During this time, the car payment typically will be accepted without penalties or other consequences. That being said, there is no legally defined grace period attached to a car loan.

Is Ally Bank owned by General Motors?

Ally Financial has remained a major auto lender since being spun off from General Motors 14 years ago, but it now faces the prospect of greater competition from the Detroit automaker.

Is Ally a good finance company?

The company has a D- rating from the Better Business Bureau (BBB), and more than 380 Ally auto finance reviews on the BBB website average out to only 1.1 out of 5.0 stars. The company has a similar Trustpilot score of 1.3 stars out of 5.0, based on more than 175 Ally auto finance reviews from customers.

What credit score do you need for Ally Financial?

Ally typically requires a FICO score of at least 620. For jumbo loans, though, borrowers need a FICO score of at least 700 and a debt-to-income ratio of no more than 43%.

Does refinancing hurt your credit?

Refinancing will hurt your credit score a bit initially, but might actually help in the long run. Refinancing can significantly lower your debt amount and/or your monthly payment, and lenders like to see both of those. Your score will typically dip a few points, but it can bounce back within a few months.

Is Ally a good auto lender?

The company has a D- rating from the Better Business Bureau (BBB), and more than 380 Ally auto finance reviews on the BBB website average out to only 1.1 out of 5.0 stars. The company has a similar Trustpilot score of 1.3 stars out of 5.0, based on more than 175 Ally auto finance reviews from customers.

How many months can I miss my car payment? How many car payments can you miss before repossession? Lenders usually won’t repossess your car until no payments have been made for 60–90 days. Legally speaking, though, most states allow them to begin the repossession process as soon as the car is in default–meaning, as soon as you’ve missed one payment.